|

Brussels, |

|

Semiconductor Battle

EU Wants its Digital Sovereignty

Brussels, 8 June 2023 - 7 MINUTES READ

Increasing pressure from the US is pushing Europe to join the semiconductor war and reconsider all Chinese investments in critical sectors in Europe. The objective is to achieve technological sovereignty over China as soon as possible. It is believed that the United States' efforts to stifle the Chinese chip industry are part of a broader plan to hinder Beijing's preparations for war. Europe, already in a historically weak position, is now forced to take remedial action before the microchip "bomb" explodes on the European economy. The parallel with energy is evident. Does Europe have the means and tools to seek its own sovereignty? Are the American concerns about China seeking semiconductor supremacy because it is preparing for war, or is it an excuse by Washington to regain industrial supremacy?

The semiconductor industry has become a battleground for the United States, China, and, more recently, Europe, with competition and tensions escalating. Semiconductors are vital components used in various technologies, including smartphones, computers, AI systems, and military applications. The global demand for semiconductors has surged, driving intense competition and geopolitical concerns.

The United States has traditionally been a leader in semiconductor innovation and production. However, China's rise as a major player in the industry, coupled with its significant investments and pursuit of self-reliance, has raised national security and economic competitiveness concerns in the US. To address these, the US has imposed export restrictions on certain semiconductor technologies to China, prioritizing national security. It has also implemented policies to support domestic semiconductor manufacturing and research, including substantial funding for fabrication facilities and R&D programs, exemplified by the CHIPS for America Act adopted in 2021.

China, on the other hand, has aggressively aimed to reduce its reliance on foreign semiconductor technologies. The Chinese government has implemented measures to stimulate domestic semiconductor production, such as increased investment in R&D, formulation of industrial policies, talent development initiatives, and market protection measures. China seeks technological advancements, improved competitiveness, and a robust semiconductor industry capable of meeting domestic demand and competing globally.

In Europe, concerns about Chinese control of critical infrastructure have led to hurdles for chip deals involving Chinese ownership. European countries, influenced by US pressure and a growing focus on technological sovereignty, have adopted stricter stances on Chinese investment in critical industries. For insance, last year, the UK government has ordered Nexperia, a Dutch subsidiary of Shanghai-listed semiconductor maker Wingtech, to sell at least 86% of its stake in Newport Wafer Fab, while Germany's economic ministry has barred Elmos Semiconductor from selling its factory in Dortmund to Silex, a Swedish subsidiary of China's Sai Microelectronics. These decisions reflect a shift toward stricter stances on Chinese investment in critical industries in Europe, driven by US pressure and a growing sense of technology sovereignty. NATO Secretary General Jens Stoltenberg has emphasized the importance of avoiding new dependencies on China and safeguarding critical infrastructure and supply chains in the Western world.

Cases involving chip deals in Europe may face legal battles if chipmakers choose to appeal, and the outcomes remain uncertain due to expanded government oversight and evolving investment regulations. Attention has also turned to the Netherlands, where the US has urged the Dutch government to restrict exports to China, particularly from semiconductor equipment manufacturer ASM.

In response to these challenges, the European Union is increasingly focused on achieving semiconductor independence and technological sovereignty. Recognizing its relatively small share of global semiconductor production, Europe acknowledges the need to reduce reliance on external suppliers and enhance its own capabilities in the industry. To facilitate this, the EU is adopting the European Chips Act (check all details here), which aims to stimulate investments, foster innovation, and strengthen research and development efforts in the semiconductor sector. The EU seeks to promote collaboration among industry players, research centers, and institutions with the ultimate goal of increasing European production capacity and enhancing competitiveness in the global chip market.

The United States has traditionally been a leader in semiconductor innovation and production. However, China's rise as a major player in the industry, coupled with its significant investments and pursuit of self-reliance, has raised national security and economic competitiveness concerns in the US. To address these, the US has imposed export restrictions on certain semiconductor technologies to China, prioritizing national security. It has also implemented policies to support domestic semiconductor manufacturing and research, including substantial funding for fabrication facilities and R&D programs, exemplified by the CHIPS for America Act adopted in 2021.

China, on the other hand, has aggressively aimed to reduce its reliance on foreign semiconductor technologies. The Chinese government has implemented measures to stimulate domestic semiconductor production, such as increased investment in R&D, formulation of industrial policies, talent development initiatives, and market protection measures. China seeks technological advancements, improved competitiveness, and a robust semiconductor industry capable of meeting domestic demand and competing globally.

In Europe, concerns about Chinese control of critical infrastructure have led to hurdles for chip deals involving Chinese ownership. European countries, influenced by US pressure and a growing focus on technological sovereignty, have adopted stricter stances on Chinese investment in critical industries. For insance, last year, the UK government has ordered Nexperia, a Dutch subsidiary of Shanghai-listed semiconductor maker Wingtech, to sell at least 86% of its stake in Newport Wafer Fab, while Germany's economic ministry has barred Elmos Semiconductor from selling its factory in Dortmund to Silex, a Swedish subsidiary of China's Sai Microelectronics. These decisions reflect a shift toward stricter stances on Chinese investment in critical industries in Europe, driven by US pressure and a growing sense of technology sovereignty. NATO Secretary General Jens Stoltenberg has emphasized the importance of avoiding new dependencies on China and safeguarding critical infrastructure and supply chains in the Western world.

Cases involving chip deals in Europe may face legal battles if chipmakers choose to appeal, and the outcomes remain uncertain due to expanded government oversight and evolving investment regulations. Attention has also turned to the Netherlands, where the US has urged the Dutch government to restrict exports to China, particularly from semiconductor equipment manufacturer ASM.

In response to these challenges, the European Union is increasingly focused on achieving semiconductor independence and technological sovereignty. Recognizing its relatively small share of global semiconductor production, Europe acknowledges the need to reduce reliance on external suppliers and enhance its own capabilities in the industry. To facilitate this, the EU is adopting the European Chips Act (check all details here), which aims to stimulate investments, foster innovation, and strengthen research and development efforts in the semiconductor sector. The EU seeks to promote collaboration among industry players, research centers, and institutions with the ultimate goal of increasing European production capacity and enhancing competitiveness in the global chip market.

Limited Semiconductor Production in Western Countries

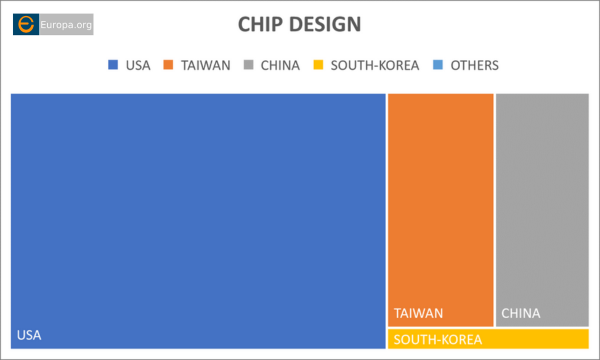

In a rapidly growing global microprocessor market, valued at nearly €600 billion annually, Europe's production contribution is a meager 9%, while the USA leads with 23%. Asia dominates with a staggering 70% production share.

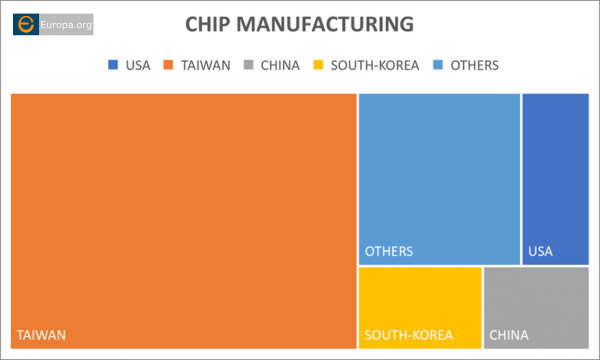

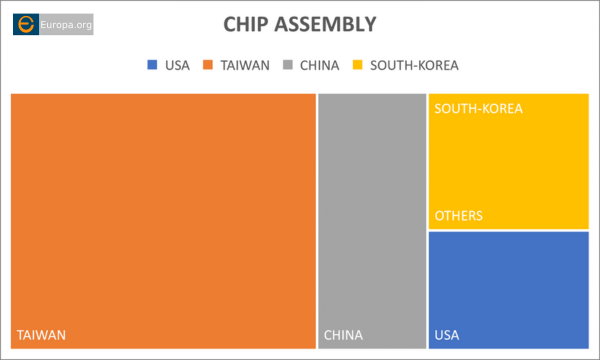

Semiconductors manufacturing is 70% in Asia, while Europe and the USA only account for 30% of production. While this has led to a 45% reduction in production costs from 1985 to the present, it has also made Western countries highly vulnerable due to their increasing tensions with China, primarily concerning Taiwan, the world's largest producer.

In a rapidly growing global microprocessor market, valued at nearly €600 billion annually, Europe's production contribution is a meager 9%, while the USA leads with 23%. Asia dominates with a staggering 70% production share.

Semiconductors manufacturing is 70% in Asia, while Europe and the USA only account for 30% of production. While this has led to a 45% reduction in production costs from 1985 to the present, it has also made Western countries highly vulnerable due to their increasing tensions with China, primarily concerning Taiwan, the world's largest producer.

|

Continue reading PREMIUM Version....

|

© Copyright eEuropa Belgium 2020-2023

Source: © European Union, 1995-2023

Source: © European Union, 1995-2023