ePolicies

INDUSTRY

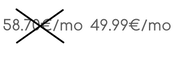

PREMIUM Plan

IN01PM

PRO & PLUS features

|

|

+ PREMIUM features

|

|

Terms

- Monthly or annual billing periods

- You manage your plan, upgrading and downgrading or cancel your current subscription and sign up for a new one

- Many payment methods

- VAT charge - European tax rules will apply to transactions in Europe. We will not charge VAT if you are a company that does not reside in Belgium. In the EU there is a reverse charge. When you are at the checkout, VAT will be calculated automatically based on your address, if applicable,. Please email us your VAT number if you are a legal person.